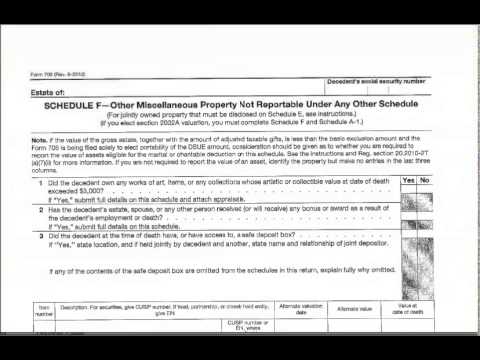

Hello, this is a continuation of the overview of the preparation of the forms. 7:06 is where we left off. Now, we are getting back to the midterm, where you must prepare an estate and gift tax return form 706. It is important to understand how it needs to be prepared. You are going to prepare it as complete as possible, given the information that has been provided. Once we get past the first four pages of form 706, which we touched upon briefly in the last video, we will get to the schedules. Let's go to Schedule A. Give me a moment to get to that schedule again. That's our starting point with the schedules. Schedules A through D and F are all about specific kinds of property. For example, real estate is reported on Schedule A. On the other hand, Schedule B includes securities, such as stocks and bonds. Initially, we have five schedules: A through D and F. Of course, there are more schedules aimed at specific kinds of properties. For the most part, assets included in the gross estate under Section 2033 are entered in these schedules. These assets are referred to as probate property. We use shorthand when we refer to them. In my prior lectures, I have talked about Schedule A through J. Sorry, I made a mistake earlier. It should be Schedule E and schedules J through I. They are used for assets reported under specific code sections. Let's go to Schedule E quickly and take a look at it while I find the page. Here it is. If you look at Schedule E, you will see that they have code sections listed here. The other schedules also have similar code sections. When you go to these schedules, they will identify the various...

Award-winning PDF software

706 example Form: What You Should Know

Form 2555, to claim the foreign earned income exclusion for qualified business income earned by your business outside the U.S. or by you and any of your spouses. If you qualify to use Form 2555, you can claim the foreign earned income exclusion using a simplified method that reduces or eliminates the time and effort required to file Form 2555. This simplified approach may be simpler as the amount of income excluded from income with the foreign earned income exclusion is limited to the least of 2.5% of the gross income excluded or 1,000,000. Form 2555 does not cover the full value of income that you include in your gross income. Form 2555 also does not cover amounts that you exclude from income in the following situations based on your adjusted gross income. Use Form 2555 if you: • had a gross income of 1,000,000 or more for a single year • had a gross income of 1,000,000 or more for two or more closely connected foreign corporations, partnerships, or S corporations • had a gross income of 500,000 or more for one such corporation, partnership, or S corporation or • held stock of such foreign corporation, partnership, or S corporation at any time If you use Form 2555 (or Form 2555-EZ) for the first taxable year, you can claim either a foreign earned exclusion or a foreign tax credit. A foreign earned exclusion is used when: You do not have enough foreign earned income to exclude the income from your U.S. income taxes. You would pay a tax to the foreign country that is equal to 1% of your gross income for that year. The foreign country has no limit on the amount of income that, when added to U.S. income earned abroad, you are limited to exclude from U.S. income taxes. For more information on how the foreign earned income exclusion works, read about Foreign Earned Income Exclusion, or For more information on how Form 2555-EZ, or Form 2555-I-OZ, Information for Employers, works, see Form 2555-EZ, Instructions for Form 2555-EZ.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Instructions 706, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Instructions 706 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Instructions 706 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Instructions 706 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 706 Example